Top Blockchain Trends to Watch for 2024

Top Blockchain Technology Trends to Follow in 2024

Being ahead of the curve is essential in the ever-changing world of cryptocurrencies. Knowing what the biggest cryptocurrency trends are going to be by the time 2023 finishes and 2024 approaches is necessary. This book examines current and future cryptocurrency developments, including new technology, legislative initiatives, and market dynamics. The worldwide market for blockchain services is expected to experience substantial growth, increasing from $3.28 billion in 2022 to $4.7 billion in 2023 and reaching an impressive $19.76 billion by 2027.

Explore the cryptocurrency world and watch for critical patterns. Whether a novice or expert, these tips assist in navigating the dynamic crypto market. Stay informed, manage risk, and adapt to market trends for successful trading and investing. You can hire a Custom blockchain development company to create your trading platform.

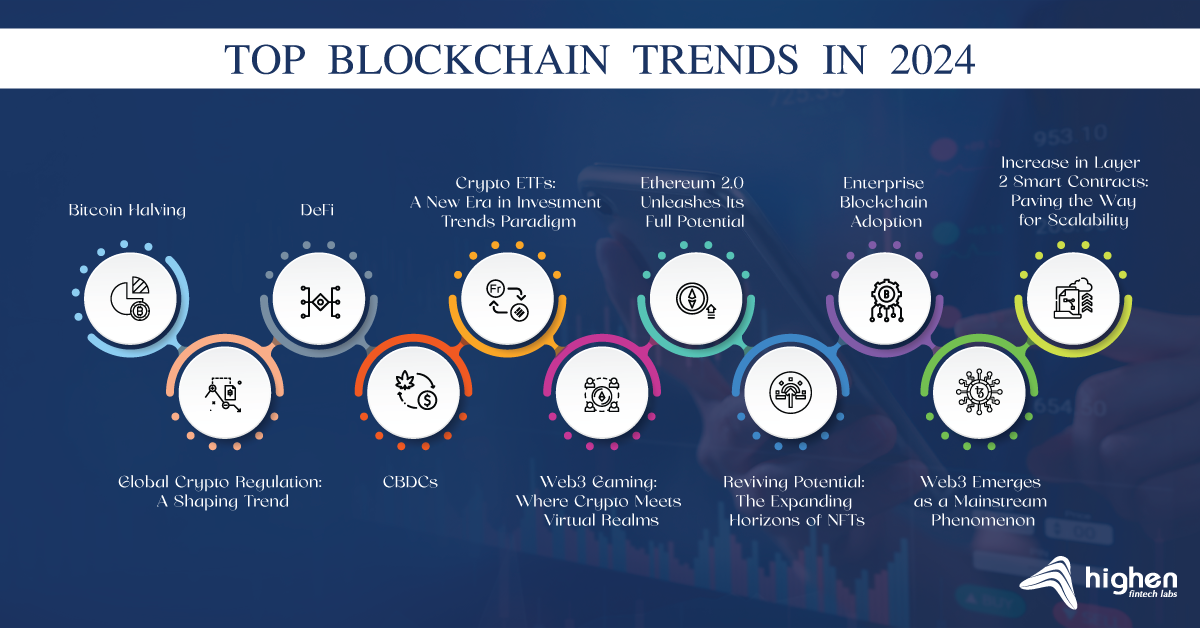

Top 10 Blockchain Trends in 2024

Blockchain is undeniably a rapidly advancing technology, exerting a substantial influence on various domains, including AI, IoT, Metaverse, and NFT. The following trends in blockchain technology are sure to captivate your attention:

Let’s examine the most significant top ten blockchain trends of the current year in more detail.

1. Bitcoin Halving

The “Bitcoin halving” is a significant event in cryptocurrency, occurring every four years. It reduces the reward for mining new blocks by half. Bitcoin halving, occurring every 4 years, reduces new Bitcoin creation, increasing scarcity and potentially boosting its value due to changed supply and demand dynamics. The crypto community and investors closely watch this event because it can influence Bitcoin’s price and the overall market dynamics.

Is monitoring this significant development in cryptocurrencies, the halving of Bitcoin essential? Above all, it’s necessary to realize that the Bitcoin halving impacts the whole cryptocurrency market. Because of the diminishing scarcity, the price of Bitcoin often rises since it grows more quickly than the quantity of new coins that are available. According to historical statistics, there was a significant surge in the value of Bitcoin after previous halving events.

When we consider the state of the cryptocurrency market now and prepare for 2024, the Bitcoin halving is noteworthy. It highlights how interwoven the cryptocurrency economy is and how crucial it is for enthusiasts to comprehend these emerging patterns.

2. DeFi

DeFi, or decentralized finance, has already influenced traditional banking and lending. Direct, trustless transactions are enabled by doing away with the necessity for banks and intermediaries. Several factors will come together in the coming year to cause its expansion to reach previously unheard-of heights.

For instance, Total Value Locked (TVL) in DeFi protocols has grown annually and is predicted to reach $100 billion by October 2023. This notable increase implies growing confidence in DeFi as more individuals put their trust in this area with their money.

AI-powered risk management solutions will be crucial as DeFi spreads swiftly. These technologies will reduce vulnerabilities and enhance security by tracking and detecting anomalies in transaction data and user activity. Your belongings will

Several sources promote DeFi’s growth in 2024. It is becoming more accessible and user-friendly thanks to its cross-chain links and intuitive UI. New DeFi apps and protocols appear daily, offering even more possibilities and functions. Institutional investors’ appreciation of DeFi’s potential is contributing to its growth.

DeFi insurance treatments are one of these kinds of goods. These protocols enable users to purchase insurance against fraud, hackers, and other damages. For instance, the Nexus Mutual protocol guards against smart contract hacking for users.

In the DeFi scenario, cross-chain interoperability will increase. Because of this, you can transfer your assets and use various apps across several Blockchains. Layer 2 solutions are increasingly being used. DeFi will increase popularity among institutional investors and consumers while scaling up and lowering transaction costs. In 2024, expect to see a rise in the direct or indirect usage of DeFi by banks and investment institutions.

3. Crypto ETFs: A New Era in Investment Trends Paradigm

The introduction of bitcoin exchange-traded funds (ETFs) is one trend creating a stir in the market as we go deeper into cryptocurrency trends in 2023 and prepare for what’s next in 2024. In 2021, the debut of the first Bitcoin ETF, like BITO, on the New York Stock Exchange marked a pivotal moment in cryptocurrency investing. These ETFs make it easier for conventional investors to access digital assets through traditional brokerage accounts.

However, some ETFs, including BITO, rely on Bitcoin futures contracts, leading to debate over their accuracy in tracking Bitcoin’s price. Grayscale’s legal victory against the SEC has raised the prospect of more crypto ETF approvals. This development may revolutionize how investors enter the cryptocurrency market, offering convenience and potential risks. The court ruled that the SEC had unfairly treated identical products differently, which might make cryptocurrency exchange-traded funds (ETFs) more widely accepted.

Spot bitcoin exchange-traded funds (ETFs) have the potential to significantly impact institutional adoption and the whole cryptocurrency market, as they provide investors exposure to cryptocurrencies without requiring them to hold the underlying assets. There will be an exciting change in the current top cryptocurrency trends as more businesses, like BlackRock and Fidelity, explore the ETF market, indicating a promising future for

4. Ethereum 2.0 Unleashes Its Full Potential

Ethereum 2.0 shifted from PoW to PoS in 2020, but its full potential remains untapped. In 2023, the transition to PoS promises exciting developments:

- Ethereum 2.0 (Serenity) shifted from Proof of Work to Proof of Stake in 2020. The full potential is yet to be realized.

- In 2023, the transition to PoS marks a crucial moment, promising scalability, energy efficiency, security enhancements, and shard chains for improved throughput.

- Improved Scalability: By substituting randomness for hash power and hence reducing block sizes, Ethereum 2.0 will completely transform the validation process. This modification guarantees that validating nodes may be operated effectively even on ordinary hardware, resulting in increased scalability and quicker transaction times.

Ethereum’s position and impact in cryptocurrency are expected to grow dramatically in 2023 due to these revolutionary developments, making it one of the significant developments to monitor closely.

5. Enterprise Blockchain Adoption

Businesses will use this technology in 2024 to improve security, expedite processes, and foster consumer trust. Blockchain offers a tamper-proof technology, which guarantees confidence. Data and transactions in the blockchain are stored in blocks visible to all network nodes upon addition to the chain, remaining there permanently. Its openness changes the game for supply chain management, healthcare, and banking industries by lowering the likelihood of fraud and fostering trust between participants.

Moreover, businesses will depend increasingly on Blockchain-powered intelligent contracts by 2024. The terms are explicitly encoded into the code, making these contracts self-executing. When specific criteria are satisfied, they operate automatically. Smart contracts cut expenses, simplify complicated procedures, and lessen the need for intermediaries. For example, in the real estate sector, these agreements enable smooth transactions and guarantee that all parties fulfill their responsibilities without issues.

Consider how Walmart, a massive retailer, tracks the movement of food goods from farm to table using blockchain technology. Transparency and food safety are ensured by this invention, which is essential for consumers and companies alike.

Similarly, IBM develops novel approaches to supply chain management that lower costs while increasing productivity. Microsoft, meanwhile, concentrates on creating identity management systems and enhancing privacy and security protocols. Blockchain is being used by even the largest tech company, Amazon, to improve cloud computing services while putting security and scalability first. Blockchain-based payment solutions were invented by financial powerhouse JPMorgan Chase to cut costs and expedite transactions.

6. Increase in Layer 2 Smart Contracts: Paving the Way for Scalability

The widespread use of Layer 2 (L2) smart contracts is another significant trend that will significantly alter the cryptocurrency ecosystem in 2023 and beyond. Although cryptocurrencies with a settlement layer, such as Ethereum and Bitcoin, operate as “Layer 1” networks, scalability is still a significant challenge.

Even with their pioneering positions, Layer 1 blockchain networks have scaling issues. In response to this difficulty, the notion of Layer 2 smart contracts was presented; these contracts function as an overlay framework that offers significant scalability enhancements. Because it allows cryptos to expand infinitely without being constrained by the limitations of their basic infrastructure, this development is essential to achieving widespread acceptance of cryptocurrencies.

The emergence of Layer 2 smart contracts brings about a significant change in the cryptocurrency ecosystem. In addition to alleviating scalability concerns, it also provides access to novel applications and practical use cases, strengthening the basis of the digital currency space. Layer 2 smart contracts are the main characters in the ongoing story of cryptocurrency developments; they are pushing the market towards new frontiers and guaranteeing that cryptocurrencies will always be more than just a speculative asset class.

7. Global Crypto Regulation: A Shaping Trend

In 2023, a global focus on cryptocurrency regulation is a key trend, driven by the need to secure investments and combat cybercrime. However, due to jurisdictional challenges among various authorities, it’s a complex task.

What are the prospects for investors in this new regulatory era? These are a handful:

- US Crypto plan: Interestingly, the $1.2 trillion bipartisan infrastructure plan the US president signed into law in 2021 included provisions for crypto tax reporting, giving the IRS the authority to keep an eye on Americans’ cryptocurrency activity.

- The 2023 G20 Summit: The leaders of the G20 meeting recently emphasized how urgent this issue is by pledging to put in place a reporting mechanism for cryptocurrency assets quickly. By 2027, the goal is to start exchanging information on non-financial crypto assets, which reflects a global endeavor to regulate digital currencies comprehensively to manage their complexity.

8. CBDCs

The rapid adoption of Central Bank Digital Currencies (CBDCs) by countries like the UAE and the Bahamas signifies a significant shift towards embracing digital currencies, setting the stage for a transformative year ahead. Blockchain is expanding its influence in diverse sectors. Blockchain education is increasingly vital to foster understanding and innovation across industries.

The incorporation of CBDCs into current financial systems is what distinguishes 2024. The days of digital currencies functioning independently are long gone. They now integrate easily with traditional economic systems, opening up a more comprehensive range of uses. With CBDCs taking on duties ranging from cross-border transactions to regular retail purchases, this integration is revolutionary.

Furthermore, the innovation of CBDCs is just remarkable. In addition to fulfilling more conventional roles like payments and settlements, CBDCs are opening the door for ground-breaking new uses. Imagine a society where digital currencies are used to efficiently distribute government benefits or where money is programmable, automating contracts and payments. These opportunities are approaching and will undoubtedly change the financial landscape.

Brazil’s Digital Real program, which has received praise from the International Monetary Fund (IMF), is a notable illustration of this transition. This initiative uses Blockchain technology to usher in a new age of financial innovation, building on the success of Brazil’s Pix fast payment system. Though it won’t be immediately available to the general public, the Digital Real is expected to pave the way for innovative financial solutions.

The view on CBDCs from a global viewpoint is also growing. The European Central Bank is one of the regulatory agencies investigating the idea of a digital euro. Their objective is to preserve the value of conventional currencies while offering dependable digital payment options. This move toward digital currencies and CBDCs is a more significant trend toward converging traditional and digital financial systems.

9. Web3 Gaming: Where Crypto Meets Virtual Realms

One notable actor in the constantly changing landscape of cryptocurrency trends for 2023 is the introduction of Web3 Gaming. The creative combination of gaming ecosystems and blockchain technology is changing how we see and interact with video games.

Web3 Gaming is a transparent and immersive gaming experience defined by decentralized apps (DApps) based on blockchain platforms. Thanks to non-fungible tokens (NFTs), players may now trade or sell their in-game assets across other virtual worlds and own them.

Furthermore, Web3 Gaming’s appeal goes beyond ownership and playability. It is the forerunner of play-to-earn models, allowing gamers to profit from their hard work and talent. This tendency increases the sustainability of the gaming sector by presenting chances for revenue generation.

As Web3 Gaming develops, it brings gamers and cryptocurrency enthusiasts together by providing a particular point of convergence. It has a bright future ahead of it and will undoubtedly become a significant crypto trend that will influence the gaming industry in 2023 and beyond.

10. Reviving Potential: The Expanding Horizons of NFTs

In the ever-evolving world of cryptocurrency trends for 2023, Non-Fungible Tokens (NFTs) are about to see a boom. Although the recent market turbulence may have temporarily obscured the picture, several cryptocurrency analysts predict NFTs will rebound significantly from their 97% decline in 2022.

NFTs are reviving across various fields in the face of a changing environment. Over the past five years, search inquiries about NFTs have increased by over 1,000%, yet their potential is beyond conventional limitations. Here are some examples of how:

- As was already noted, the gaming industry is still vital for NFTs. A robust market is supported by players using NFT-linked digital assets for in-game benefits. Leading participant in the gaming space, ImmutableX, reported $87 million in NFT trading volume in 2022—a startling 250% rise from the year before.

- Fashion houses are also starting to embrace NFTs; giants like Prada and Nike are leading the way. Prada combines luxury with blockchain technology with its unique NFT collections, providing clients access to special events and limited-edition items.

- NFTs are expanding into unexplored markets, such as real estate, where the tokenization of tangible assets may bring unprecedented liquidity and operational efficiencies. There are countless opportunities ahead for these as the NFT ecosystem in fashion, art, gaming, and other fields develops.

11. Web3 Emerges as a Mainstream Phenomenon

One significant change that is imminent in 2023 cryptocurrency developments is the mainstreaming of Web3. Web3 represents a paradigm change in how we view and use the internet. It captures the fundamental ideas of peer-to-peer networks, decentralization, and user empowerment found in the blockchain.

The philosophy of decentralization has permeated many aspects of our online experiences. Blockchain-powered Web3 apps and platforms can restore consumer control and lessen the sway of digital behemoths.

Web3 is poised to facilitate trustless interactions, transparent governance, and digital asset ownership in crypto. The metaverse, NFTs, and decentralized finance (DeFi) are essential elements of this movement.

Web3 will go beyond specialized crypto circles and become more ubiquitous as user-friendly interfaces and increased accessibility develop. With more people adopting Web3, the digital landscape is expected to change, and people will have more control over their online assets and visibility. This is a crucial cryptocurrency trend to watch in 2023 and beyond.

Conclusion

Having gained insight into the Top 11 Blockchain Trends for 2024, it is essential to continue your. Blockchain education to fully use this rapidly advancing technology. Today blockchain development companies are growing at a rapid rate. By 2024, the. Blockchain space will have changed a great deal. Blockchain is expanding its influence in diverse sectors. Blockchain education is increasingly vital to foster understanding and innovation across industries. Both experts and novices have the rare chance to interact with practical Blockchain applications and learn about their theoretical underpinnings.

stay abreast of the most recent top Blockchain trends in 2024 and stay connected for the latest updates in the Blockchain space. Thinking about developing a blockchain solution? Share your requirements with us today!