What is Fintech – A Complete Guide (Updated)

Fintech - The Complete Guide on Financial Technologies

FinTech Introduction:

Welcome to the exciting world of fintech! In today’s fast-paced digital age, financial technology is revolutionizing the way we do business and manage our finances. From mobile payment apps to blockchain-based solutions, fintech is transforming the financial landscape in unprecedented ways. But with so many options available, it can be hard to navigate this complex and rapidly evolving industry. That’s why we’ve put together a comprehensive guide on everything you need to know about fintech – from its history and trends to key players and future developments. So buckle up and join us as we explore the innovative world of fintech! Fintech app development has become increasingly popular as more and more people rely on technology to manage their finances.

Fintech Statista:

. Global Fintech investment reached a record high of $105 billion in 2020, despite the pandemic, according to KPMG.

. The number of Fintech unicorns (startups valued at $1 billion or more) has grown to over 100 globally, according to CB Insights.

. Digital payments are expected to reach $6.7 trillion in transaction value by 2023, up from $3.9 trillion in 2020, according to Statista.

. The global blockchain market size is expected to grow from $3 billion in 2020 to $39.7 billion by 2025, according to MarketsandMarkets.

. The global online lending market is expected to grow at a CAGR of 20.3% from 2020 to 2027, according to Allied Market Research.

What is Fintech?

The fintech industry is a term used to describe the collection of companies that are using technology to provide financial services. It is a rapidly growing sector that is transforming the financial services industry by providing innovative solutions that are more accessible, efficient, and cost-effective than traditional financial services.

The fintech industry is made up of a diverse range of companies, from startups to established financial institutions. These companies are using technology to provide financial services in areas such as banking, payments, lending, insurance, and investment management.

Fintech companies are leveraging new technologies such as blockchain development, artificial intelligence, and machine learning to provide more advanced solutions. For example, blockchain technology is being used to create more secure and efficient payment systems, while artificial intelligence and machine learning are being used to provide investment advice and automate customer service processes.

The fintech industry is attracting significant investment, and new companies are emerging all the time. According to a report by KPMG, global fintech funding reached a record $111.8 billion in 2018, and the industry shows no signs of slowing down.

What is Fintech in Banking?

Fintech in banking refers to the use of technology to provide financial services in the banking industry. Fintech has transformed the way banks operate and provide services to their customers. Banks are now using fintech solutions to improve customer experience, reduce costs, and increase efficiency.

One of the most significant areas where fintech has had an impact on banking is mobile banking. Mobile banking allows customers to access banking services using their mobile devices, such as smartphones and tablets. This provides customers with the ability to check their account balances, transfer money, pay bills, and even apply for loans from the convenience of their mobile devices. Mobile banking has made banking more accessible and convenient for customers, and it has also reduced the costs associated with traditional banking services.

Fintech has also transformed the lending process in banking. Online lending platforms are now providing customers with access to credit without the need for traditional banks. These platforms use technology to assess the creditworthiness of customers, and they offer competitive rates and flexible repayment terms. This has made borrowing more accessible and affordable for customers, while also reducing the costs associated with traditional lending processes for banks.

Another area where fintech has transformed banking is in the area of payments. Fintech solutions such as digital wallets, mobile payments, and blockchain-based payment systems have made payments faster, more secure, and more efficient. These solutions have also reduced the costs associated with traditional payment methods such as checks and wire transfers.

Fintech has also enabled banks to streamline their operations and improve efficiency. Banks are using automation, artificial intelligence, and machine learning to automate processes such as customer service, fraud detection, and risk management. This has reduced costs and improved the speed and accuracy of these processes.

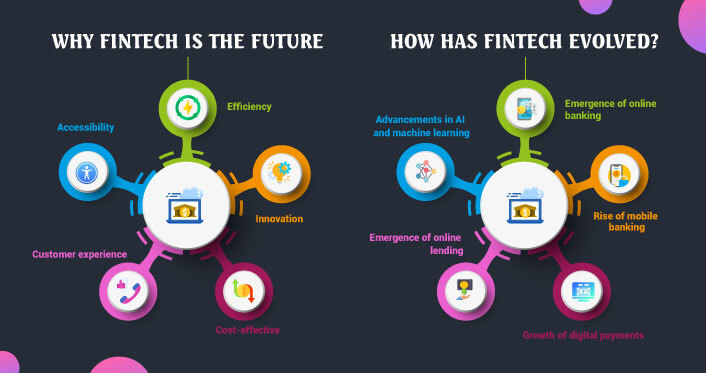

Why Fintech is the Future

1. Accessibility: Fintech is making financial services more accessible to people who were previously underserved or excluded from traditional banking services. Fintech solutions such as mobile banking and online lending are allowing people to access financial services from their smartphones or computers, without the need for physical bank branches.

2. Efficiency: Fintech is making financial services more efficient by using automation, artificial intelligence, and machine learning to automate processes such as customer service, fraud detection, and risk management. This reduces costs and improves the speed and accuracy of these processes.

3. Innovation: Fintech is driving innovation in the financial services industry by leveraging new technologies such as blockchain, artificial intelligence, and machine learning to provide more advanced solutions. This is leading to the development of new financial products and services that were not previously available.

4. Cost-effective: Fintech solutions are often more cost-effective than traditional financial services. This is because fintech companies have lower overhead costs and can offer competitive rates and fees to their customers.

5. Customer experience: Fintech is improving the customer experience by providing more personalized and convenient solutions. For example, mobile banking apps allow customers to access banking services from their mobile devices, while digital wallets and mobile payments are making payments faster and more convenient.

How has Fintech Evolved?

1. The emergence of online banking: The first wave of fintech innovation came in the late 1990s with the emergence of online banking. This allowed customers to access banking services through the Internet, eliminating the need for physical bank branches.

2. Rise of mobile banking: The widespread adoption of smartphones in the early 2000s paved the way for mobile banking, which allowed customers to access banking services through mobile devices. This provided customers with more convenience and accessibility, and it also allowed banks to reduce costs by closing physical branches.

3. Growth of digital payments: The rise of e-commerce and mobile devices has led to the growth of digital payments, including mobile payments, digital wallet app development, and blockchain-based payment systems. These solutions provide customers with faster, more convenient, and more secure payment options.

4. The emergence of online lending: Online lending software solutions platforms have emerged as an alternative to traditional banks, offering borrowers access to credit without the need for collateral or credit history. These platforms use technology to assess creditworthiness and offer competitive rates and flexible repayment terms.

5. Advancements in AI and machine learning: The growth of AI and machine learning has enabled fintech companies to automate processes such as fraud detection, risk management, and customer service. This has led to increased efficiency and lower costs for both fintech companies and customers.

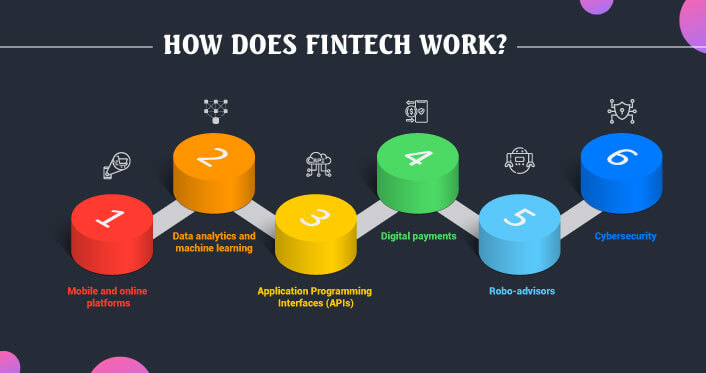

How Does FinTech Work?

1. Mobile and online platforms: Fintech companies typically operate through mobile and online platforms that allow customers to access financial services through their smartphones or computers.

2. Data analytics and machine learning: Fintech companies use data analytics and machine learning to analyze large volumes of data and make informed decisions about creditworthiness, risk management, and fraud detection.

3. Application Programming Interfaces (APIs): Fintech companies use APIs to access data from other financial institutions and build new products and services on top of existing banking infrastructure.

4. Digital payments: Fintech companies offer digital payment solutions such as mobile payments, digital wallets, and blockchain-based payment systems that provide customers with faster, more convenient, and more secure payment options.

5. Robo-advisors: Fintech companies use algorithms and data analysis to provide personalized investment advice to customers at a lower cost than traditional financial advisors.

6. Cybersecurity: Fintech companies prioritize cybersecurity to protect customer data and prevent fraud. They use advanced encryption and authentication technologies to ensure that customer information is secure.

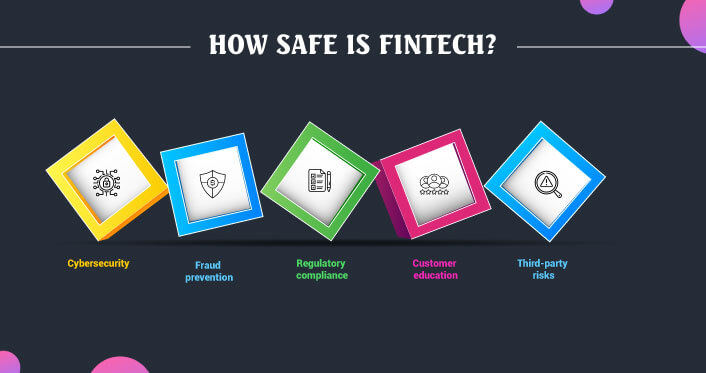

How Safe is FinTech?

1. Cybersecurity: Fintech companies store and process sensitive financial data, making them attractive targets for cybercriminals. To mitigate these risks, fintech companies invest heavily in cybersecurity measures, such as encryption, authentication, and access controls.

2. Fraud prevention: Fintech companies use various fraud prevention techniques, such as identity verification, device recognition, and transaction monitoring, to detect and prevent fraudulent activities.

3. Regulatory compliance: Fintech companies are subject to regulatory requirements, including consumer protection laws and anti-money laundering (AML) and Know Your Customer (KYC) regulations. Compliance with these regulations helps ensure the safety and security of customers’ financial information.

4. Customer education: Fintech companies need to educate their customers about the risks associated with using their services and provide guidance on how to protect their personal and financial information.

5. Third-party risks: Fintech companies may use third-party service providers for various functions, such as payment processing or data storage. These third-party providers may introduce additional risks, so fintech software development companies need to conduct due diligence and ensure that their vendors meet the same security standards they do.

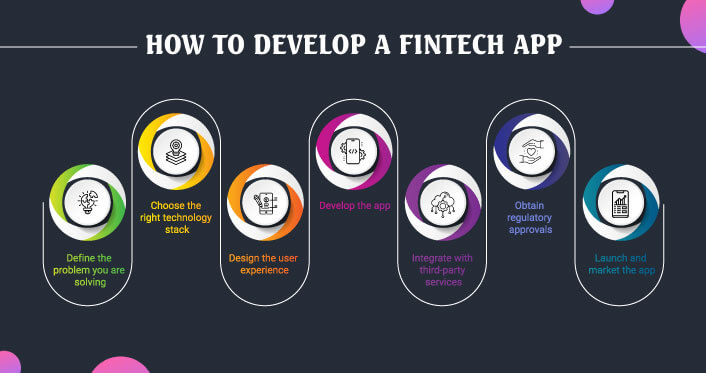

How to Develop a Fintech Application?

1. Define the problem you are solving: Before you start developing your app, you need to define the problem you are solving and the target market you are serving. Conduct market research and gather feedback from potential customers to ensure that your app meets their needs.

2. Choose the right technology stack: Fintech apps require a robust and scalable technology stack that can handle large volumes of transactions and sensitive financial data. Choose a technology stack that is secure, reliable, and meets regulatory requirements.

3. Design the user experience: The user experience is critical to the success of a fintech app. Consider the needs of different types of users, such as retail customers, businesses, and investors.

4. Develop the app: Develop the app using agile development methodologies and test it rigorously to ensure that it is secure, reliable, and meets regulatory requirements.

5. Integrate with third-party services: Fintech apps often require integration with third-party services such as payment gateways, banking APIs, and KYC/AML services. Ensure that these integrations are secure and compliant with regulatory requirements.

6. Obtain regulatory approvals: Depending on the nature of your app, you may need to obtain regulatory approvals from financial regulators such as the SEC, FINRA, or CFTC. Ensure that your app complies with all applicable regulations before launching it.

7. Launch and market the app: Once your app is developed, tested, and approved, launch it in the market and market it to your target audience. Use social media, email marketing, and other channels to reach your target audience and promote your app.

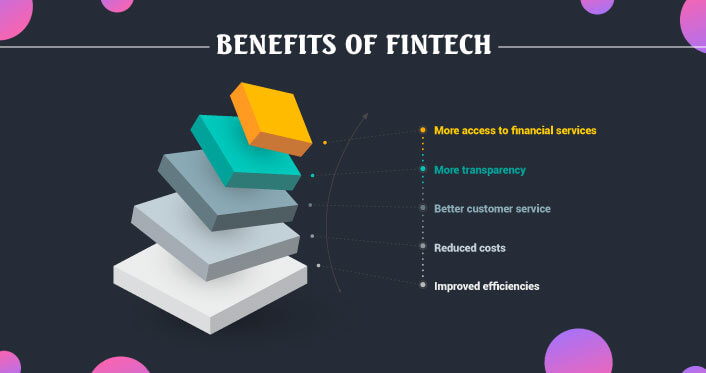

Benefits of Fintech

1. More access to financial services: Fintech enables people to access a wider range of financial services than ever before, including peer-to-peer lending, mobile payments and digital currencies. This is particularly beneficial for people in developing countries who may not have access to traditional banking infrastructure.

2. More transparency: Fintech provides increased transparency around pricing and terms of financial products and services. This can help consumers make better-informed decisions about where to invest their money.

3. Better customer service: Fintech companies are often able to offer a more personalized service than traditional banks or financial institutions.

4. Reduced costs: Fintech can help businesses to reduce costs by automating manual processes and increasing efficiency. For example, online invoicing and accounting tools can save businesses time and money on administrative tasks.

5. Improved efficiencies: By streamlining processes and improving data management, fintech can help businesses to run more efficiently.

Types of Fintech Applications and Solutions

1. Payment Processing: Payment processing is one of the most commonly used fintech applications. It allows businesses to accept payments from customers via credit card, debit card, or ACH transfer.

2. Lending: Lending is another popular fintech application. There are a variety of lending platforms that allow businesses to access capital for their business needs.

3. Accounting and Bookkeeping: Accounting and bookkeeping are critical functions for any business. Fintech solutions can automate these tasks and make them more efficient.

4. Tax Preparation: Tax preparation can be a complex and time-consuming task for businesses. Fintech solutions can help simplify the process and make it more efficient.

5. Financial Planning and Analysis: Financial planning and analysis are essential for any business to make sound decisions about its finances. Fintech solutions can provide businesses with the tools they need to make informed decisions about their money

Conclusion

We hope this fintech guide has given you a better understanding of the fintech industry and all the potential it holds. Fintech is transforming the financial landscape and creating innovative solutions for businesses and customers alike. With its growing popularity, more people are turning to fintech as a way to manage their finances efficiently and securely. While there’s still much more to learn about this ever-changing field, we trust that now you have a better sense of what a fintech app development company can do for you.