Best FinTech APIs to Use in Your Finance Software

Introduction

In the fast-paced banking world, the right API is a game-changer. This guide explores the “Best Fintech APIs” driving the financial revolution, from startups to established institutions. Discover APIs empowering reliable, customer-centric solutions. Whether it’s enhancing payments, accessing financial data, or automating operations, this resource will accelerate your Fintech endeavors. There are Financial software development companies who can help you with API development.

What are Fintech APIs?

APIs (Application Programming Interfaces) connect various systems in fintech, granting access to data for banks, third-party providers, customers, and websites. Fintech apps rely on APIs for real-time data, transforming the financial industry. Third parties access data with client consent, reshaping finance operations.

It is simple to grasp this technology because APIs are becoming more and more prevalent in financial technology. If banks wish to broaden their services, they must engage with other parties for this. Additionally, businesses must make it quick and straightforward for customers to pay with their preferred method. And the fintech APIs make all of these things feasible. Developers use these financial APIs to build banking and finance-related apps, which speed up and reduce the cost of services.

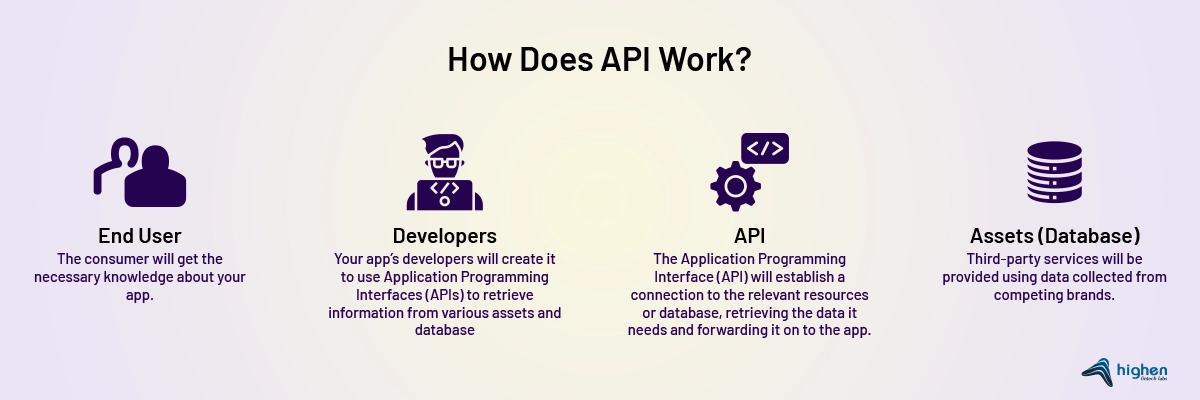

How Does APIs Work?

In all fintech solutions, APIs are recognized as the intermediaries between various software components that are utilized to exchange data. The APIs for fintech apps include a number of functionalities that may be specifically tailored for different uses, allowing application developers to use them as the foundation for brand-new software solutions. The digital building blocks known as fintech APIs (application programming interfaces) provide the smooth integration of financial technology services into a variety of applications and systems. With the help of these APIs, communication between various software programs, databases, and financial institutions is made easier. Here is how they function:

Bridges between various elements of the financial ecosystem are created via fintech APIs. An e-commerce website or mobile app, for instance, can securely interact with banks and payment gateways via a payment processing API, enabling users to conduct transactions. These APIs ensure that payments are performed properly and securely by transmitting data and instructions between the requesting application and the financial service provider. Fintech APIs offer standardized functions and data structures, simplifying development and reducing the need for extensive financial expertise.

Advanced web technologies like GraphQL and RESTful APIs power Banking APIs. These enable real-time data exchange, enhancing user experiences. These APIs are versatile, serving various financial services, from lending to personal finance management. Fintech companies offer these user-friendly, standardized APIs, empowering businesses and developers to create innovative financial solutions, thereby improving the efficiency and accessibility of financial services.

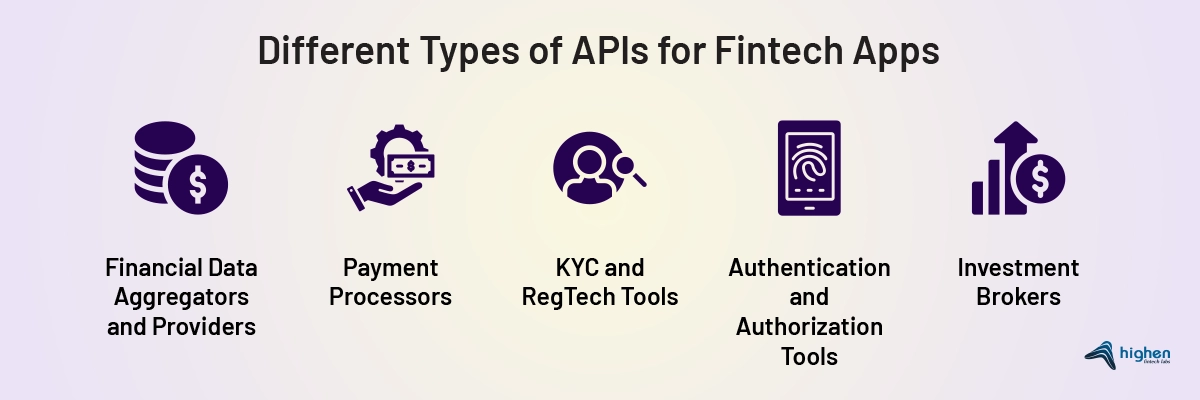

Different Types of APIs for Fintech Apps

Explore APIs; the feature you need for your app may already be available. Discover how various APIs can enhance your financial application.

1. Financial Data Aggregators and Providers

APIs grant third-party apps access to users’ financial data, including bank statements, and facilitate the delivery of banking services by these apps. Most significant financial organizations offer APIs. For example, Citibank provides a wide range of APIs to developers so they may create apps that link to their banking services, such as account management, bill payment, and security.

2. Payment Processors

Payment processors like Stripe, PayPal, and MangoPay play a pivotal role in the fintech sector and the broader Internet economy through APIs. They enable digital transactions by acquiring, validating, and processing payments. Statista survey reveals payment sector as top-performing fintech area due to widespread fintech app reliance on payments. Payment processors, including anti-fraud, security, and forex, are becoming the minimum API standard.

3. KYC and RegTech Tools

KYC is crucial but poses challenges in apps – longer onboarding, higher costs, and security concerns. E-KYC tools like ShuftiPro offer video and face biometrics. Alloy uses AI and data for full KYC automation. RegTech is also advancing the compliance landscape by automating formerly manual operations. Ascent Tech, for instance, uses AI to identify regulatory concerns and direct organizations toward compliance. There is little doubt that compliance will be a difficult, time-consuming, and expensive requirement in the future of fintech. However, there are ways to handle it, and one of those methods is via using APIs for KYC and RegTech.

4. Authentication and Authorization Tools

Cyberattacks on fintech demand robust security. Integration of security APIs is essential as threats evolve. Native biometric authentication (e.g., Apple, Android) and tools like Duo Auth API bolster security. APIs alone can’t ensure safety; the entire software ecosystem plays a role.

5. Investment Brokers

Developing trading programs within investment apps is complex and risky. However, high-quality broker APIs offer a shortcut akin to human brokers. Broker APIs offer a range of services, like Interactive Brokers for comprehensive market access or Polygon.io for extensive stock data.

CoinAPI’s access to cryptocurrency exchanges is valuable for those exploring cryptocurrencies. Integrating these tools into your app is seamless, making it easy to incorporate them into various fintech applications, from financial management to online banking. Broker APIs are a powerful resource in the realm of investment app development.

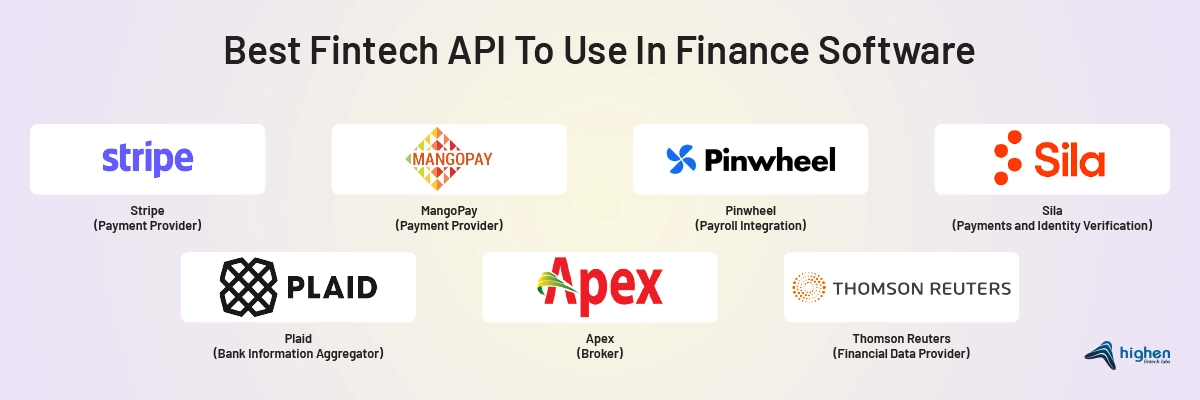

Best Fintech APIs To Use In Finance Software

1. Stripe (Payment Provider)

Stripe is an app in fintech that enables users to manage and process online payments. It is also used by custom commerce and SaaS. It comes with features like securing transactions, consistent service, easy-to-use reporting features, and democratic fees.

2. MangoPay (Payment Provider)

MangoPay is a fintech API that many fintech companies use because it offers multiple currency payments with the help of various local payment methods. In this API, all the payment flows and commissions are automated, and this is possible because of one single contract of MangoPay. It is designed in such a way that developers can easily integrate the payment solution on the business platform, and this is because of the open-source SDKs.

3. Pinwheel(Payroll Integration)

Pinwheel is a popular payroll connectivity API company that is utilized by the majority of FinTech companies to access income and update direct deposits securely. It is an API that helps neobanks connect to a client’s payroll information system and enables offering things like income verification, direct-deposit switching, and paycheck-linked lending.

4. Sila(Payments and Identity Verification)

Sila is an API platform that can issue an ERC-20 stablecoin. And this coin is known as SilaToken (SILA). Every transaction on the software is done using this token. Sila enables the installation of international payments, card payments, business ID verification, and more.

5. Plaid (Bank Information Aggregator)

Initially, Plaid used to create financial service APIs that would help clients share their banking information more easily. But in 2018, they started offering their fintech solutions to a wider class of people. It can be used as a bank information aggregator. It helps streamline bank account authentication, fraud prevention, user income validation, comprehensive transaction history, and transaction geological tracking.

6. Apex (Broker)

Apex comes with a robust and booming suite of APIs that helps in investing and trading for lifecycle starting from bank account opening and more. Many fintech startups use this fintech API because it enables the users to execute across various asset classes like bookkeeping, fractional order, and stock locate support.

7. Thomson Reuters (Financial Data Provider)

Thomson Reuters offers critical information that helps in deciding the legal, financial market data, tax, and media. The tax and accounting APIs by this company include.

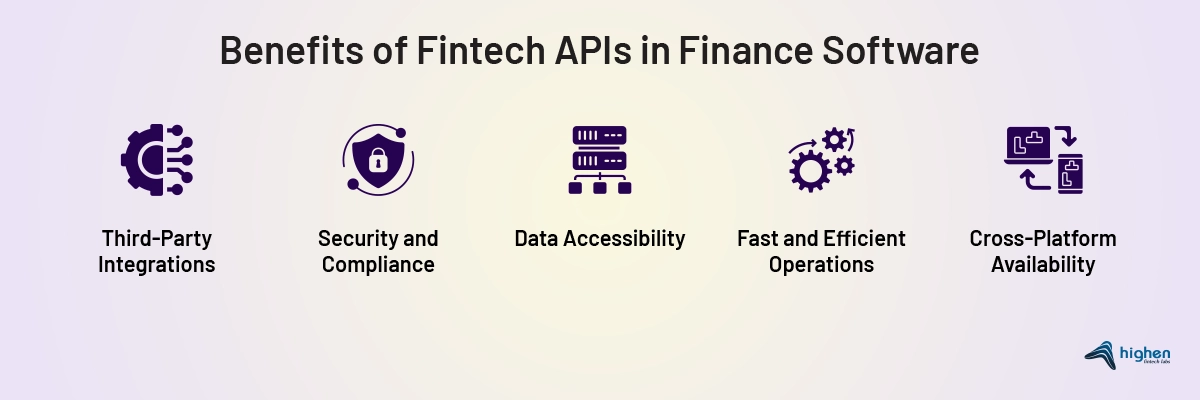

Benefits of Fintech APIs in Finance Software

1. Third-Party Integrations

In fintech, users demand frequent new services, but development is costly. Hence, many opt for third-party APIs, which are cost-effective for diverse offerings.

2. Security and Compliance

Many countries have introduced rules and regulations for financial organizations to offer third-party services that can help in accessing clients’ data, and this is all to support the open banking concept. Basically, fintech APIs can work on open and sensitive data. They offer security and compliance to financial institutes.

3. Data Accessibility

In this digital world, keeping data secure or hidden from the public is impossible. And for this, PSD2 was introduced. But it has also made it difficult for the users and programs to access important and required data. PSD2 enables third parties to access financial data. This means that the right to access or manage data is possible because of GDPR and PSD2. Because of this, users are now able to have the legal right to understand how their personal or financial information is used.

4. Fast and Efficient Operations

Companies are able to easily add new features to the application and aid in hastening the introduction of new services with the aid of API solutions in fintech. In addition, they assist in the development of specifically tailored API functions. APIs also make it simple for customers to manage their banking activities through web, mobile, and digital wallet services. Fintech APIs enable easy digital banking, covering 90% of traditional transactions, saving time and costs through web, mobile, and digital wallets.

5. Cross-Platform Availability

Financial organizations use APIs to provide cross-platform support for their users. Versions of the apps for desktop, mobile, and wearables provide seamless client support.

Top Use Cases of Fintech APIs

1. Digital Banking

With time, mobile banking has developed into a crucial component of the financial sector. And more financial institutions are becoming mobile-friendly as neobanks like Revolut and GoCardless mushroom. Additionally, this draws in a wide range of customers, making it simple for them to handle their bank account information, financial transactions, data analytics, and many other things.

2. Cryptocurrency & Blockchain

The idea of cryptocurrency has caused the financial services sector to undergo a new metamorphosis and has caused customers to reconsider how they interact with money. The technology underlying cryptocurrencies, blockchain, has made it exceedingly safe to share and store financial data. Additionally, every financial institution has benefited greatly from this.

3. Investment Management

The world of investing has also been altered by fintech. With the aid of several applications, it has simplified investment. Applications like Robinhood are available on the market to help consumers invest their money and learn everything there is to know about the market.

4. Verification Engines

When users initially submitted their information for verification, numerous staff employees handled the process.

5. Payments

Fintech has enabled real-time payment processing. Today, every corporate entity offers digital payment processing services to allow consumers to make payments. And the firms’ payment processors’ API interfaces make this feasible. Businesses like Venmo, PayPal, Stripe, and Square have been particularly helpful in this regard.

6. Enables to Offer White Label Services

While numerous businesses on the market provide branded APIs, white-label APIs are also offered to both fintech companies and banks. Additionally, these APIs allow conventional banks or financial institutions to take advantage of their features without having to develop their software and platforms.

Final Thoughts of FinTech API

As we get to the end of our examination of the “Best Fintech APIs,” it is abundantly evident that these electronic links are essential to contemporary banking. They make it possible for frictionless transactions, data-driven insights, and customer-centered experiences that are changing the business landscape. The Fintech industry is dynamic, and the API market is always changing. Selecting the appropriate API partner may be a strategic choice that affects the outcome of your foray into financial technology. You have a potent toolkit at your disposal with the APIs we’ve identified to promote innovation, improve security, and offer the financial services of tomorrow. Use the greatest Fintech APIs at your disposal to integrate and revolutionize finance.

Interested in integrating an activity feed or chat API to your fintech app or platform? Get in touch with our sales team today.